Strategy (formerly MicroStrategy) made its largest Bitcoin purchase since November 2024, the day before the price of Bitcoin fell below the $90,000 threshold.

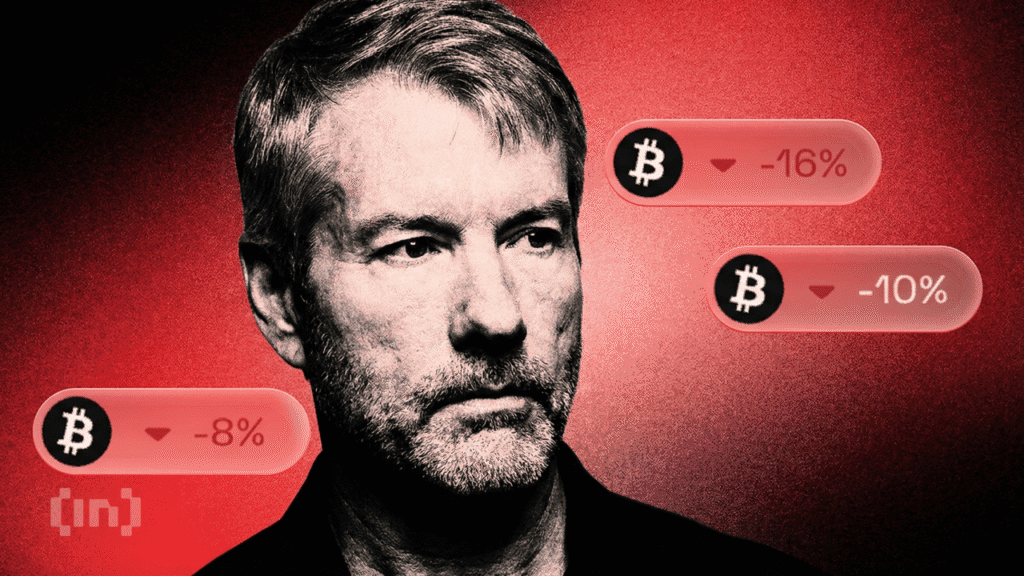

Despite the company’s consistent commitment to an aggressive accumulation strategy, Strategy’s stock price fell more than 7%.

Sponsored Sponsored

Strategy’s largest Bitcoin purchase since 2024

On Tuesday, Strategy announced the acquisition of 22,305 Bitcoins for approximately $2.13 billion, bringing its total Bitcoin holdings to 709,715 Bitcoins.

The transaction, which took place on Monday, was Strategy’s largest Bitcoin purchase since November 2024. The company also reaffirmed its continued commitment to growing its Bitcoin assets following two follow-on acquisitions completed in early January.

Despite the size of the acquisition, market reaction remained muted. Like the acquisition announced last Monday, this move did not increase investor confidence in Strategy’s long-term prospects.

The company’s stock has fallen 7.39% in the past 24 hours, with MSTR trading at $160.87 at the time of writing.

The company’s approach to the timing of Bitcoin purchases is also drawing attention.

Sponsored Sponsored

Bitcoin continues to accumulate despite market downturn

According to Monday’s disclosure, Strategy paid an average price of $95,284 per Bitcoin. However, on the same day, Bitcoin traded around $92,500, and the next day it briefly fell below $90,000.

The timing highlighted a recurring pattern of strategies failing to take advantage of short-term price declines.

In December, BeInCrypto reported that the company spent nearly $1 billion to acquire 10,624 Bitcoins. At the time, Bitcoin had fallen to around $86,000, but the strategy executed the purchase after the price recovered to around $90,615.

This approach raises ongoing questions about the company’s entry point strategy and apparent willingness to accumulate Bitcoin at high price levels rather than during market pullbacks.

It has also done little to allay shareholder concerns about broader capital allocation decisions.

Despite a modest recovery over the past month, Bitcoin has not been able to regain the $100,000 level. At the same time, analysts’ growing concerns about a potential bear market have increased uncertainty about the asset’s near-term price outlook.

Against this backdrop, Strategy continues to advance its accumulation plans.

While this approach is intended to demonstrate confidence in Bitcoin’s long-term prospects, it has so far done little to alleviate investors’ short-term concerns.