Ethereum (ETH) has shown little price movement in the past two weeks despite the wider cryptocurrency market showing bullish momentum.

This stagnation in ETH prices occurs when sales activities are strengthened. These factors suggest a careful, short-term outlook for Ethereum as the week continues.

Ethereum investors secure profits

Recent data shows significant sales pressure on Ethereum. Over the past 48 hours, investors have sold over 225,779 ETKEN. This volume will be converted to supply worth around $576 million, reflecting the rapid pace of off-roading.

Such large sales indicate a decline in investor confidence. Many seem to secure profits amid doubts about further price increases. This behavior often indicates a shift towards risk aversion in the short term.

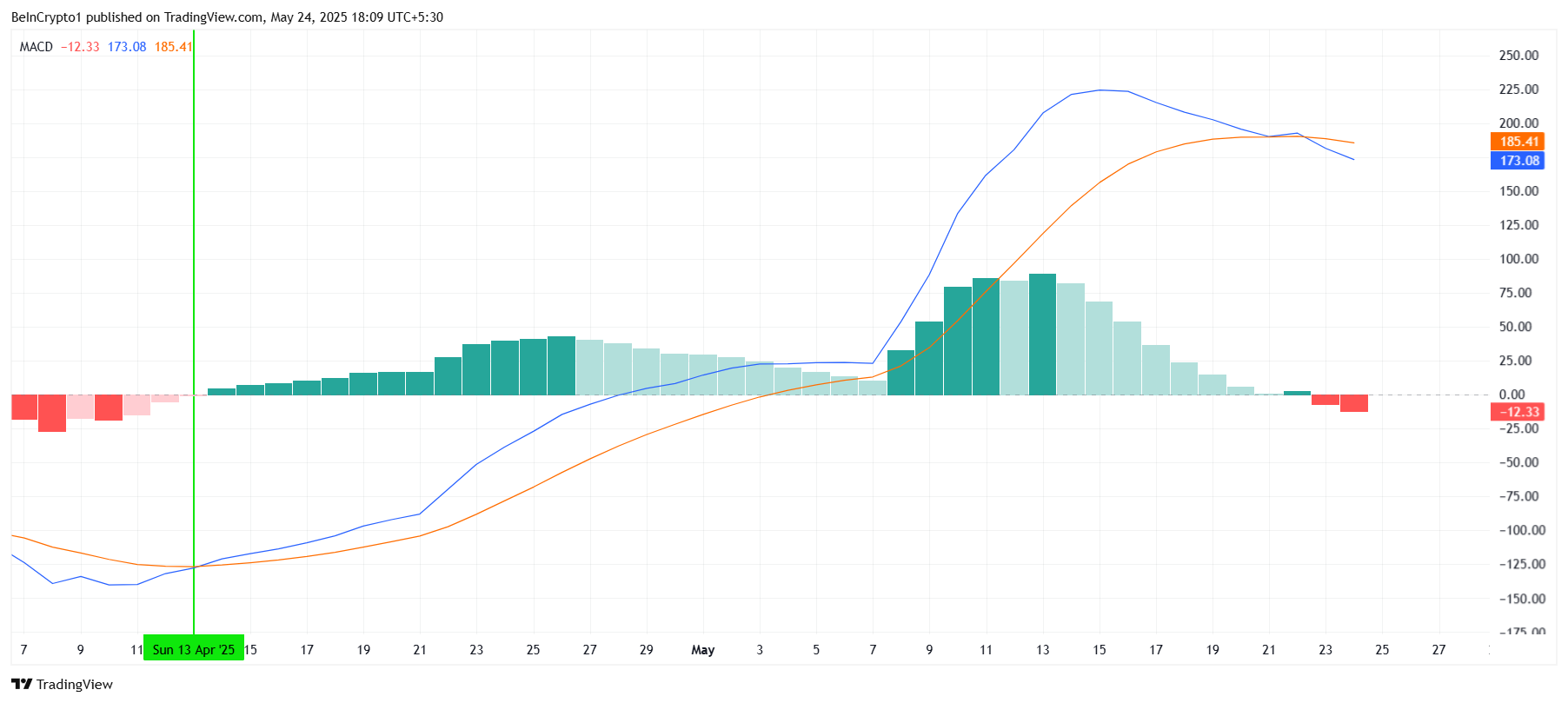

Technical indicators add bearish sentiment surrounding Ethereum. Moving average convergence divergence (MACD) shows a bearish crossover after nearly seven weeks of bullish momentum. This change often precedes a drop in price or an increase in volatility.

Losing bullish momentum weakens Ethereum’s price support. Without fresh purchase interest, ETH could face further downward pressure as it adjusts its position according to technical signals.

ETH prices are stuck

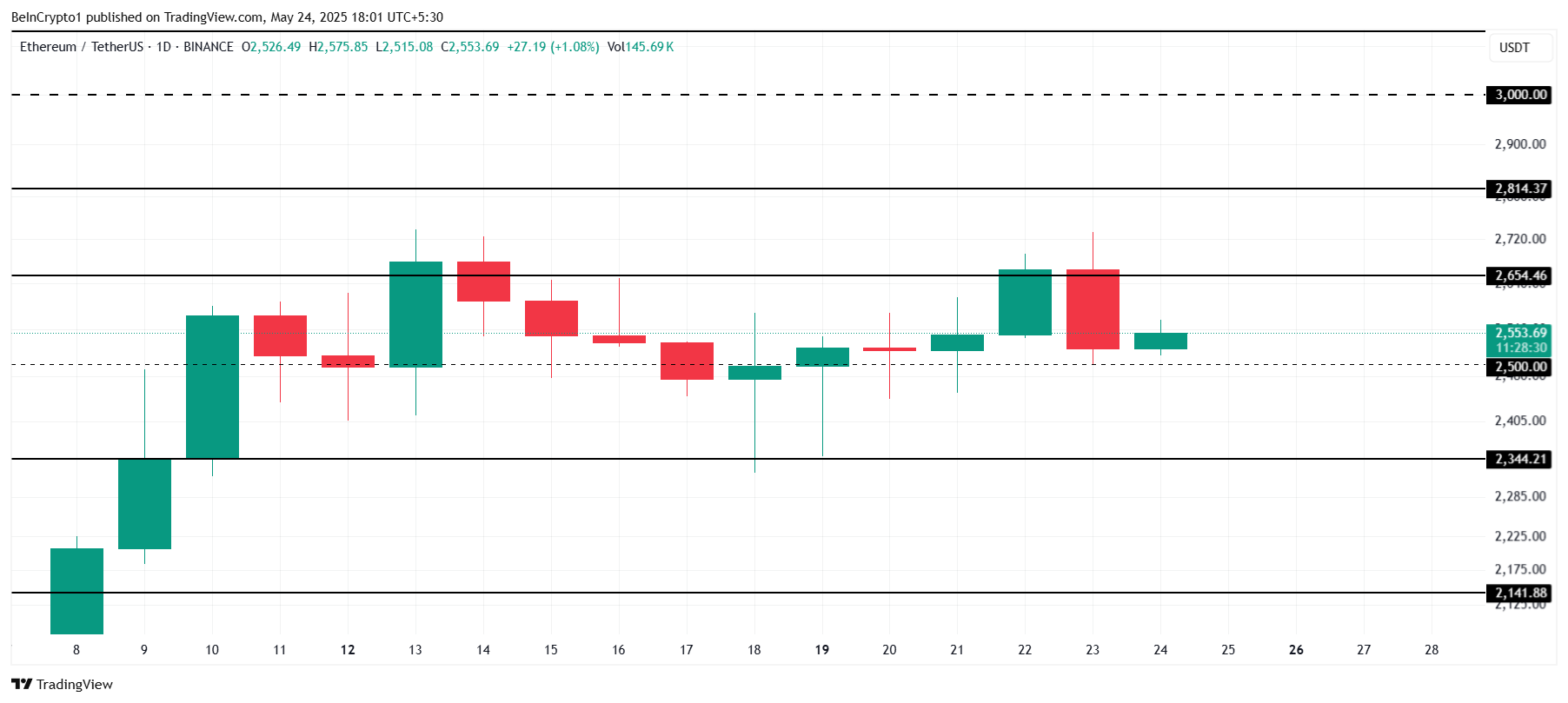

Ethereum is currently trading nearly $2,553 and maintains a critical support level of around $2,500. Altcoin King has been hovering past this threshold for a while, but its ability to maintain this level has been tested.

If bearish pressure continues, Ethereum could fall below $2,500 and move towards $2,344 for next support. However, when you purchase interest, ETH may consolidate between resistance levels between $2,500 and $2,654.

To change the short-term bearish outlook, Ethereum must break a resistance of nearly $2,654. A sustained move beyond this point could push prices to $2,814, rekindle investor optimism and support further profits.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.