Solana’s prices have gained a lot of momentum over the past week. It rose 10% amidst improved sentiment across the broader cryptocurrency market.

This new optimism drives the coin upwards and gains bullish momentum, making Sol appear ready for a sustained gathering.

The market momentum changes to Solana’s favor

The last week’s Sol double-digit gathering has resulted in prices trading within Daily Chart’s rising parallel channel.

Want more token insights like this? Sign up for Editor Harsh Notariya’s daily crypto newsletter.

This pattern is formed when the price action creates a series of higher and higher low values, moving between two upward parallel parallel trend lines. The lower boundary acts as a dynamic support, and the upper bound acts as a resistance

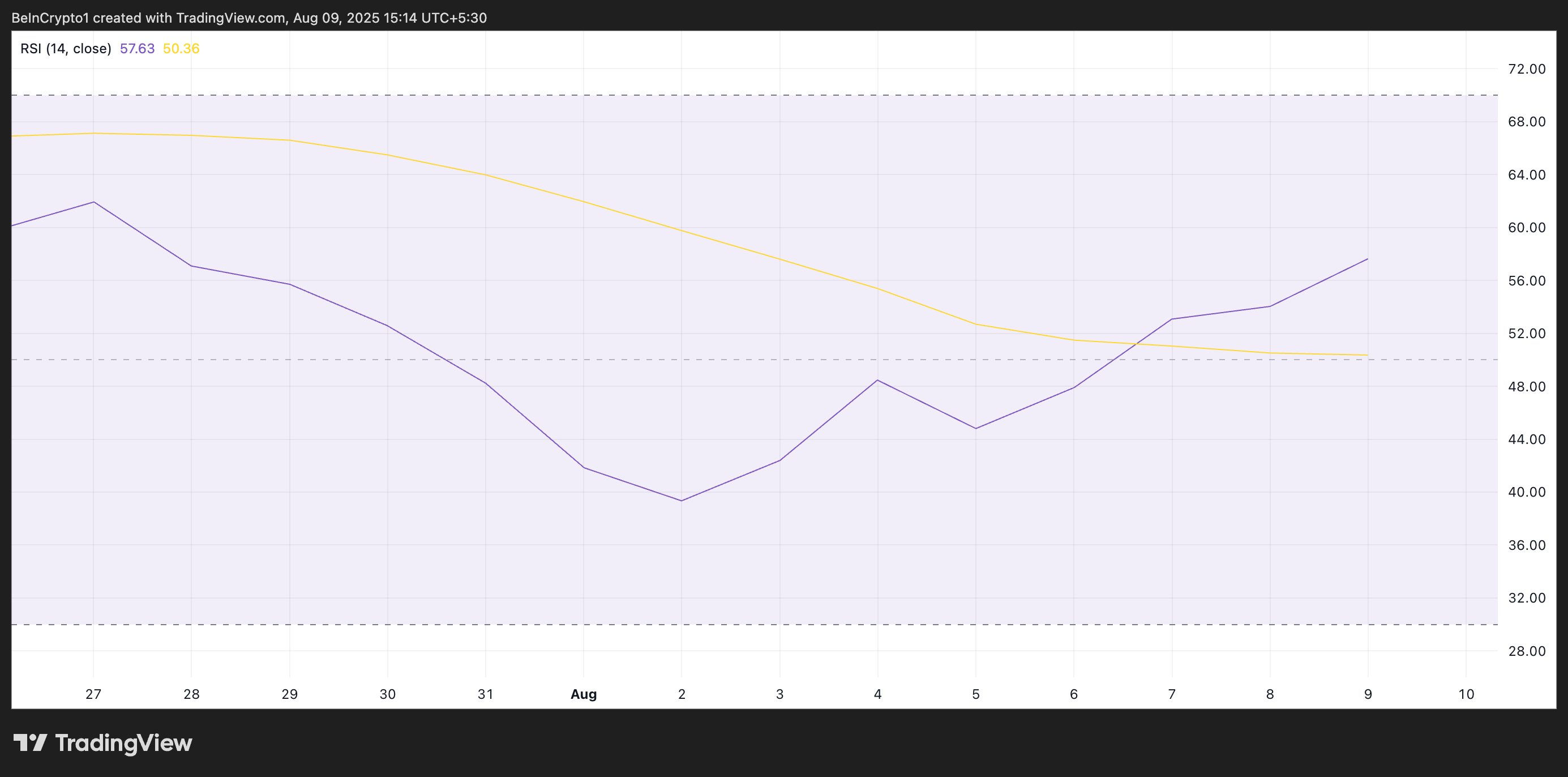

When assets are traded within such channels, they show an upward trend in which demand exceeds supply. Measurements from the SOL’s relative strength index (RSI) confirm the buy-side pressure currently supporting the rally. At the time of writing this article, this momentum indicator is at 57.63.

The RSI indicator measures the market conditions for asset acquisitions and overselling. It ranges from 0 to 100. Values above 70 suggest that the asset is over-acquired and paid for a price drop, while values below 30 indicate that the asset is over-sold and may witness a rebound.

RSI measures of SOL indicate that market participants prefer accumulation over distribution. If this trend continues, prices may continue to rise.

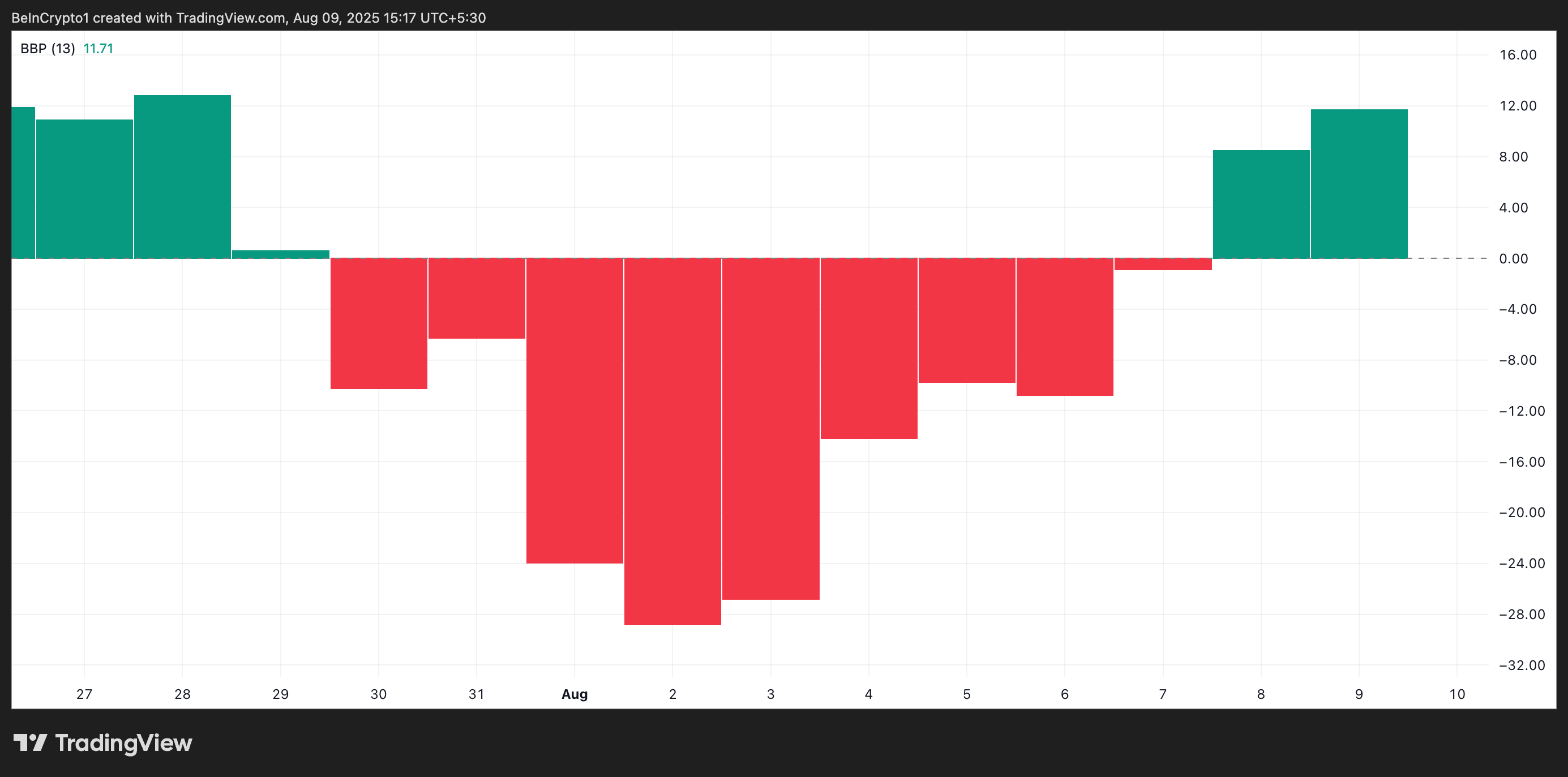

Additionally, Sol’s Elder-Ray index has remained positive in the last two trading sessions, showing a major shift after the 9-day red histogram bar. This shift shows a positive change in market momentum, with the index currently at 11.71 at the time of pressing at 11.71.

The Elderley Index measures the balance of power between buyers and sellers. When that value is positive, bullish pressures outweigh bearish pressures, and buyers gain market control.

In Sol’s case, its Elderley index strengthens bullish outlook, suggesting that recent gatherings could be extended if purchase rights continue.

Solbulls and Bears are close to $186

In press time, Sol changes his hands at $181.82 and sits under the upper limit of $186.52, the ascending parallel channel, just below the resistance level.

A surge in purchasing pressure could see tokens break through this barrier and pass the psychologically important $190 mark.

However, if sales pressures return, Sol loses its recent profits and drops to $176.64.

Solana’s weekly profits suggest a potential breakout that exceeds this price.