Over the past 24 hours, the price of Link, the native token of the ChainLink project, has skyrocketed by nearly 12%, attracting strong attention from the Crypto community.

As regulatory clarity begins, links position themselves as an important bridge between traditional finance and blockchain.

Genius Act: ChainLink’s Catalyst

ChainLink’s current rally is more than just a short-term “pump.” It appears to show fundamental shifts within the ecosystem.

One of the biggest drivers is the official passing of the Genius Bill Act. The law provides legal clarity for stable assets and digital assets, allowing US banks to legally detain encryption and stablecoins.

“US Stablecoin regulations launch a wave of new stubcoin in the US and around the world. They all need to use protected areas and cross-chain connections as a source of payment for the growing digital asset economy and tokenized funds.

In this context, ChainLink plays a key role as an infrastructure layer that connects real data and assets to the blockchain. As genius acts become effective, traditional financial institutions need mechanisms to ensure interaction with regulatory digital assets. That’s where ChainLink’s ace (automatic compliance engine) comes in.

The ACE is designed to ensure that cross-chain transactions and digital assets management are fully compliant with existing legal frameworks. Currently, banks are allowed to formally enter the digital asset market, so ChainLink through ACEs can become a critical “compliance gateway,” which increases the demand for linked tokens within the infrastructure.

“The Genius Bill Act has been passed and stable coin transparency is in effect. Banks are allowed to keep custody codes and stable ones. These banks can also issue their own silly things. Many need a way to the market. X users listed.

Expansion of adoption

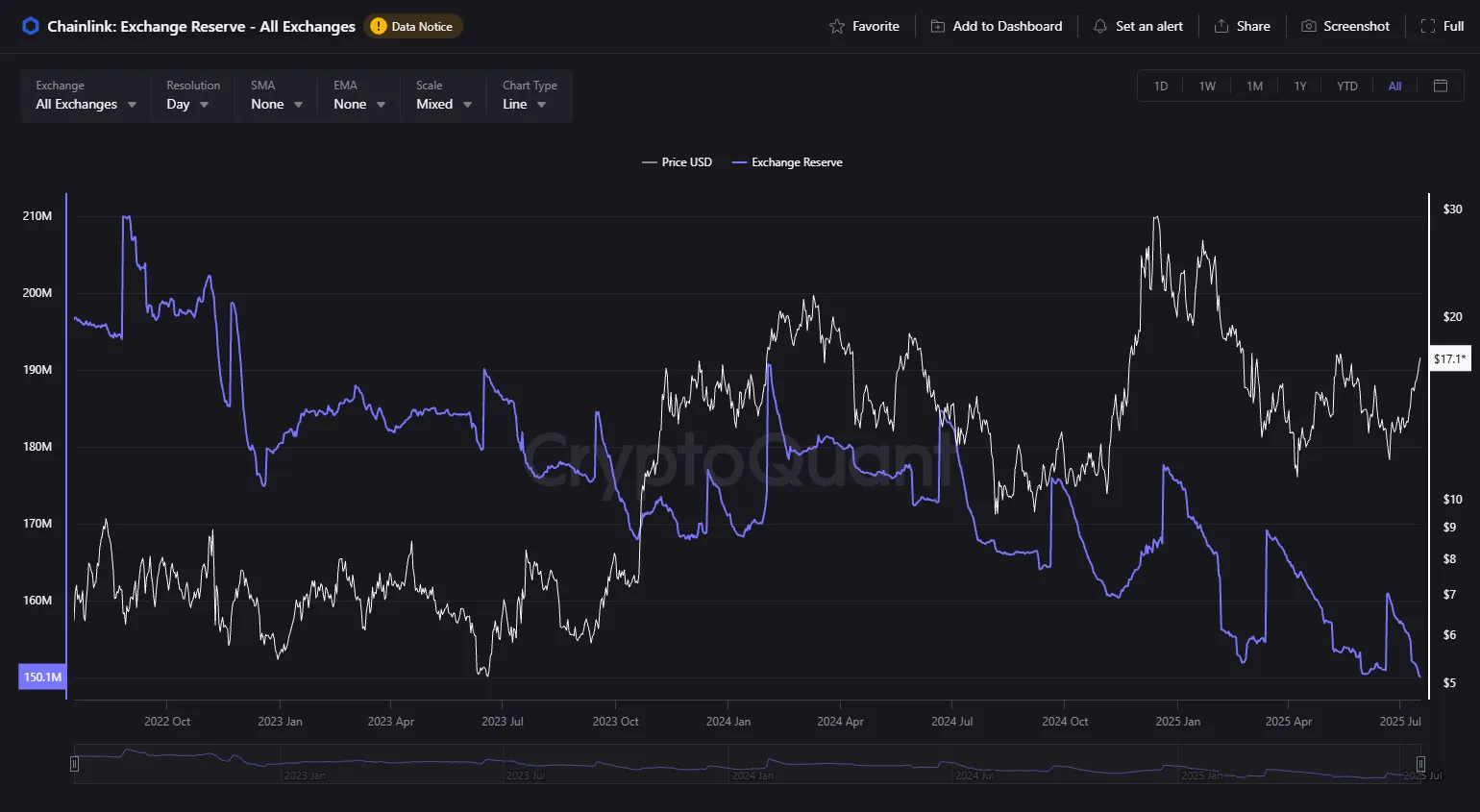

Another factor that contributes to the surge in Link’s prices is the decline in token supply to an all-time low. This is a bullish indicator and suggests increased long-term confidence in the project.

As sales pressures drop and link demand rises through use cases such as staking, Oracle data services, and compliance engines, purchasing pressure can be dominated and link prices can be even higher.

Furthermore, ChainLink Standard, a framework for integrating data between blockchain networks and traditional finance, is increasing adoption across the financial ecosystem.

A recent update from CEO Sergey Nazarov reveals that Chainlink’s vision has evolved beyond merely a “data oracle.” It has established itself as a compliance-centric data infrastructure for the global financial system.

“The future of the global financial system is on-chain, and the on-chain world must have a globally adopted standard (ChainLink standard) on how on-chain transactions work reliably to create new global financial systems, both within and across the country’s financial ecosystem,” commented Sergei Nazarov.

With regulatory policies, advanced technology, strategic collaboration with major financial institutions and aggressive developments in growing investor trust, ChainLink is entering a new phase of strategic growth. The recent 12% price surge could only be the beginning of a long-term recovery cycle.

Disclaimer

In compliance with Trust Project guidelines, Beincrypto is committed to reporting without bias and transparent. This news article is intended to provide accurate and timely information. However, we recommend that readers independently verify the facts and consult with experts before making decisions based on this content. Please note that our terms and conditions, privacy policy and disclaimer have been updated.