Trump has grown 7% over the past 24 hours, with price trading at $10.34 at the time of writing. Despite this short-term recovery, Altcoin’s broader outlook remains bearish, affected by ongoing market conditions.

The recent conflict between Elon Musk and Donald Trump could add more uncertainty and potentially deepen the bearish trend.

Trump’s leaks rise

Trump’s Relative Strength Index (RSI) is currently located in the negative zone under the neutral mark. This suggests that the broader market cues are bearish and present a major challenge for Trump’s recovery.

Duration in the negative zone indicates that momentum is weak and sellers continue to dominate the market.

Bearish feelings are exacerbated by recent market uncertainty surrounding nausea between Musk and Trump. The ongoing tension between these two influential figures could further contribute to the lack of positive momentum for Trump.

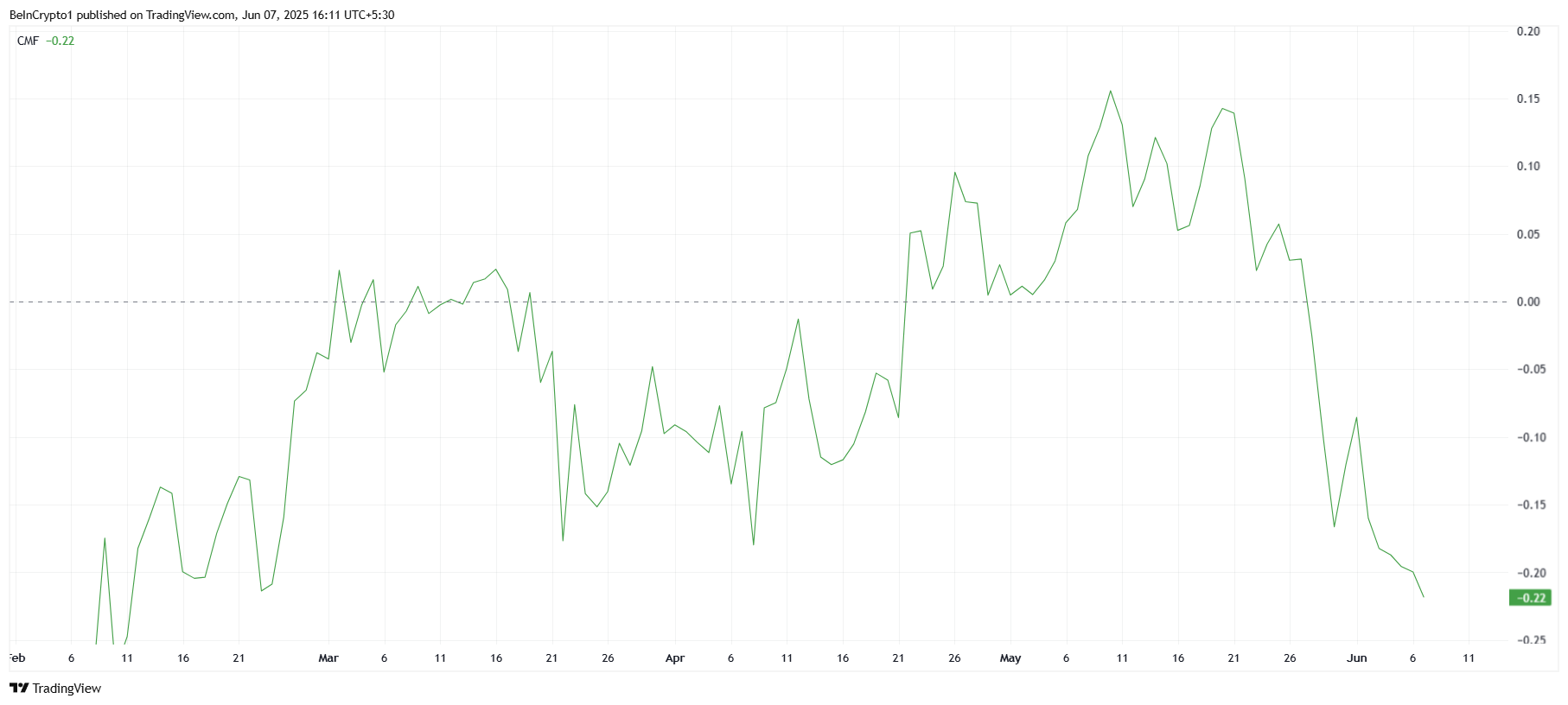

From a macro perspective, the Chaikin Money Flow (CMF) indicator highlights the dominant trend of leaks from Trump.

The CMF has recently fallen to its lowest level in over three months, indicating that there is little purchasing pressure to support the price of the asset. This shows increased confidence among investors in Trump’s long-term value.

The market response to the Musk-Trump conflict could amplify these outflows.

According to Nic Puckrin, Crypto analyst and founder of the Coin Bureau, tensions between Musk and Trump could have a negative impact on the wider market.

“The public spat seen between Musk and Trump was nothing, even unpredictable. But given the impact on the news cycle, the market doesn’t like this at all, and it could get worse as emotions escalate… This uncertainty continues over the weekend, along with the Trump source saga. I said.

Trump’s price recovery may be difficult

Trump is currently trading at $10.48, up 7.6% over the past 24 hours. However, the token faces serious resistance at $10.97. This level has proven difficult to violate in recent weeks.

Given current market sentiment, it appears Trump will have a hard time overcoming this resistance and will likely limit price movements in the short term.

Given the current bearish factor and lack of strong buying momentum, Trump could remain integrated between the support levels of $10.97 to $9.68.

This consolidation could last as the market tackles the effects of outflows and investor uncertainty, making it difficult for Trump to make significant profits.

As Trump supporters shift their outlook and turn more bullish, the token could violate the $10.97 resistance. Successful support at this level triggers a move to $12.18, invalidating the current bearish paper.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.