In the last week of May, the cryptocurrency market experienced a slower trading activity as participants earned profits following recent rallying.

Despite this short lull, some altcoins have attracted the attention of large investors commonly known as whales, who have accumulated positions in anticipation of a potential price rise in June.

dogecoin (doge)

Doge, a major meme coin, is one of the assets crypto whales have accumulated for potential profits in June. This trend is reflected in the recent surge in Doge accumulation among whale wallets holding 1 million to 10 million tokens.

According to Santiment, the group’s Doge whales added 30 million tokens to their wallets last week.

Such purchasing activities by whales often serve as strong signals for retailers. Watching large investors gain confidence in their positions can encourage retail participation. This could increase Doge’s value in order to gain momentum across the market.

If purchasing pressure is present, the token could resume meetings and rise to $0.206.

However, if whales buildup stalls and sells strengthened, Doge’s value could drop to $0.175.

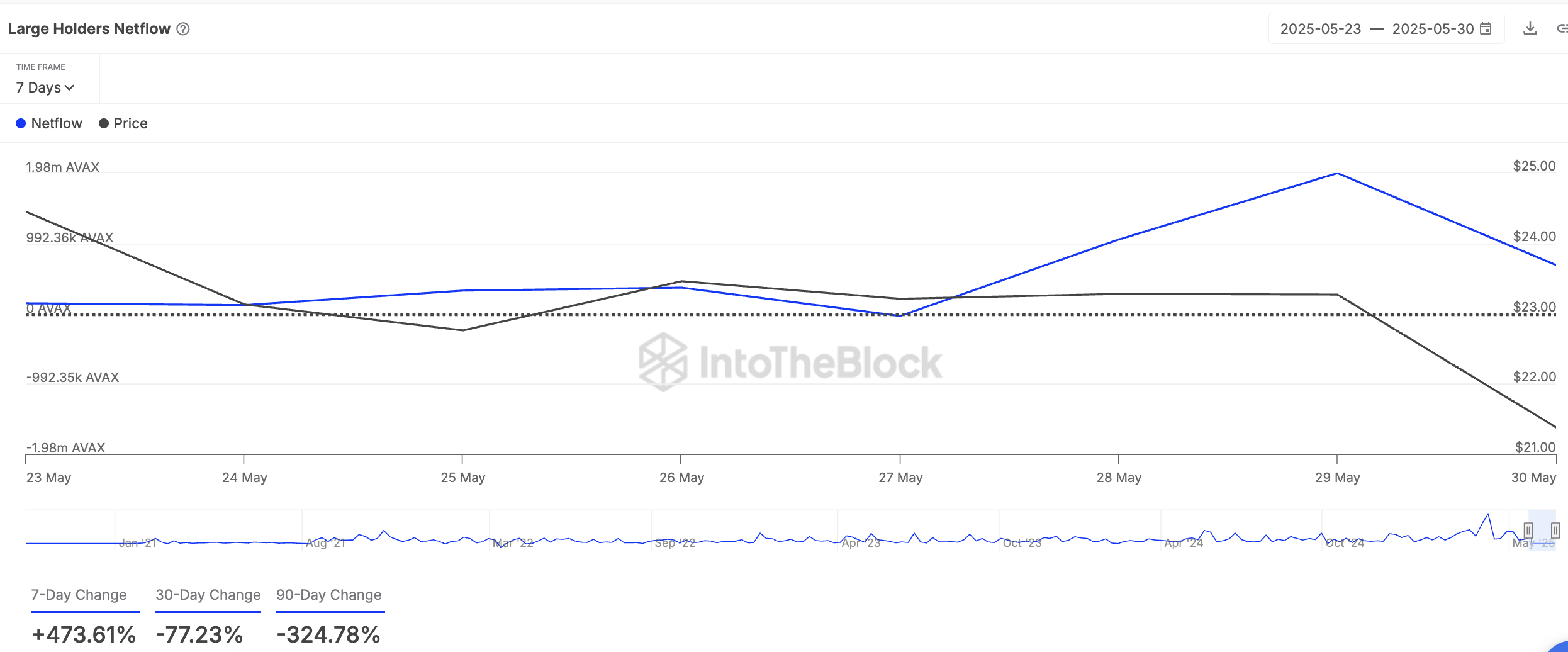

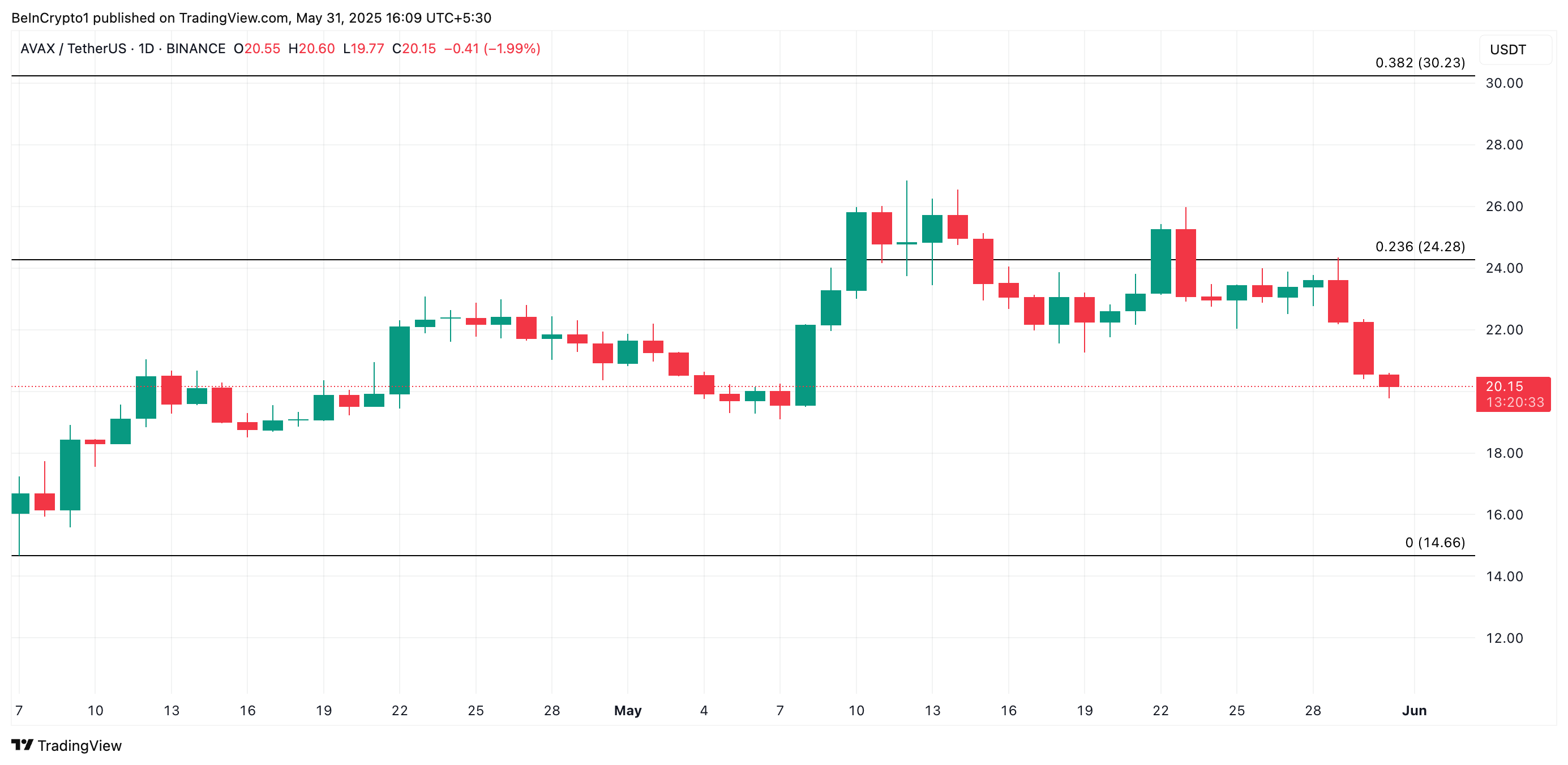

Layer-1 (L1) coin avax is another asset that whales are profiting in June. This is reflected in a 474% increase in Netflow for large-scale holders of coins over the past seven days.

Large holders are the addresses of whales that hold more than 0.1% of the distribution supply of assets. Their Netflow tracks the difference between the coins they buy and the amounts sold over a specific period.

As the Netflow of large owners of assets increases, many of their tokens flow into the wallets of these major investors rather than the leak. This trend shows that avax whales are accumulating assets and show confidence in future value.

The Avacks witness a rebound and could surge to $24.28 if whale accumulation continues.

Meanwhile, if whales start selling for profit, the price of Altcoin could drop to $14.66.

QUANT (QNT)

QNT opposed the broader market slump this week, recording a profit of 7%. Nearly 10% of tokens gatherings appear to be fueled by new investors’ interests after the launch of Overledger Fusion, a layer 2.5 network designed to bridge the institutions, businesses and distributed finance (DEFI) ecosystem.

It also fueled a surge in whale accumulation shown by a 1083% gathering on Netflow of large token holders over the past week. The rise shows increased confidence in QNT’s short-term performance, suggesting the possibility of further gatherings as large investors increase exposure.

If these traders continue to buy QNT, they can raise the price to $115.20.

However, once Selloffs resumes, QNT could fall below $101.87 and fall to $93.52.

Disclaimer

In line with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Although Beincrypto is committed to accurate and unbiased reporting, market conditions are subject to change without notice. Always carry out your research and consult with an expert before making any financial decisions. Please note that our terms and conditions, privacy policy and disclaimer have been updated.